Let’s be honest: Are you attached to your “regular” corporate credit cards? We’ll explain below why you should rethink this approach for the future. Because even if benefits, miles and payback have their appeal – new, smart corporate credit cards as part of a financial operating system can save your employees and, above all your accounting department, work and hassle in many places and thus make your financial processes more streamlined.

In the spotlight: Why corporate credit cards as part of an OS win out over external credit cards

- Eva Harmeling

- 21.02.22

- 9 min read

Corporate credit cards: the use case so far

Admittedly, the move from petty cash to corporate credit cards already was a major liberating blow for employees and accounting departments. After all, card payments provided a much better overview of expenses than the petty cash ever could. A corporate credit card also made the option of employees paying in advance and then being reimbursed by the company for their expenses (sometimes more and sometimes less timely) increasingly rare. The traditional debit charge? Also comparatively elaborate. So the corporate credit card definitely has one or two achievements to it. Why we still think there’s a better solution than a company-wide credit card?

Take a count: How many credit cards does your company have? Is there one for everyone, or does each department get its own company card? Maybe even each employee gets their own credit card when needed because they are cheaper to purchase in a bundle?

If there is only one credit card, the purchasing process alone is likely to be difficult: The SMS sent by the 3D-Secure obligation probably does not land directly with the employee who wants to pay with the corporate-wide credit card. The same applies to cards issued per department. By the time the required card has been obtained and then the supervisor has sent the code for two-factor authentication, it will at best have expired. Quick purchases? Not likely. A precise overview on the monthly statement of who initiated which transaction and when? Nonexistent. Security gaps caused by passing a card around should not be underestimated either.

The much better use case for the corporate credit card

With all these payment tools and expenses, if you can still keep track at the end of the month of who paid for what and, more importantly, who approved it in advance: kudos! If accounting has to ask for more info before invoices can be allocated and pre-approved due to many transactions via corporate credit cards, this use case may not be the most ideal for your workflows.

Why not integrate your corporate credit cards into an automated financial operations system? This will give you:

- a better overview of your expenses

- more control over transactions with more flexibility for those who initiate payments

- less manual work in accounting and thus

- more efficient financial processes

Yes, change is hard. After all, humans are creatures of habit, and that even extends to the contents of their wallet and the familiar color scheme of the check card collection. To convince you to say goodbye to your bank credit cards (at least for your business), we anticipated a productive discussion with you. Read our argument here.

Advantages of integrated corporate credit cards over external cards

What is the benefit of no longer obtaining corporate credit cards from the bank where also my corporate account is located?

How is your accounting system currently set up – surely at least a bit digitized already, right? Perhaps you are already using a financial operating system like finway. After all, in addition to avoiding numerous piles of paper, invoices literally flying around, and fiddling with columns in Excel, it can make your finances clearer and more automated (we’d be happy to tell you more about it here).

A holistic financial operating system makes your bookkeeping easier and frees up more time not only for accounting, but also for employees from other departments to do the really important things. Virtual credit cards, or even physical ones linked to the financial operating system, are the next logical step in realizing the full potential of your financial processes.

For example, a virtual card can be created directly for purchase requests (for a headset, educational literature or seminars, the new laptop). Unlike with a “merry-go-round card,” your employees don’t have to search for the responsible manager first and then play telephone with the credit card data. This is not only safer and quicker, but also spares the nerves of everyone involved.

It’s even easier in case someone needs to buy breakfast at the station in the beginning of a business trip: Employees no longer have to pay for it in advance or ask for it later (or take responsibility for it). Ideally, coffee and sandwiches can be paid for directly via a card issued to the employee. Via the link to the OS, they immediately receive a reminder to upload the invoice for the transaction. The coffee drinker can immediately photograph the receipt with their mobile and upload it via the app. This also saves the accounting department the tedious task of allocating the receipts.

You don’t want to equip your employees with their own cards? You can issue both prepaid and debit cards via finway: This way, you have full security over payment options, while at the same time showing your employees appreciative trust in the form of their own company card.

But debit cards are not credit cards, are they?

You’re right, the term corporate credit card has become established as a proxy for all types of corporate cards. Other than American Express and the like, our smart finway corporate cards do not grant you a credit. The cards are fed via the wallet in the financial operating system, which you have to top up via your business account. This certainly takes away some leeway when it comes to payments, as transactions are settled immediately. However, we think you gain security from it, knowing what your liquidity and cash flow situation is at all times. Debit cards give you a high level of control because you can track expenses in real time. Instead of delayed statements and a long list of transactions that are difficult to track, with finway debit card payments you know on a daily basis which department is spending how much and what for. It’s also faster to catch fraud than with credit cards. What’s more, you can deactivate cards with just a few clicks as part of a financial operating system like finway – or you can provide employees with a one-time virtual card for certain expenses that expires after payment.

And what if an important payment doesn’t go through within the system?

To ensure that your payments always go through, you need to keep two things in mind in the system (very simple!): First, that the (virtual) company cards you create or issue to employees are designed for the intended payments, i.e. have an availability limit large enough for the planned transactions. Second, it’s important to have enough money in the wallet (i.e., the “account” in the financial operating system) to make the payment through it.

That sounds like a lot of planning compared to a traditional credit card? Yes and no. You just shouldn’t tie the amount you expect to pay to your cards to the decimal point. After all, you most likely don’t use up every last cent in your accounts, but always have some money “on the side” to avoid overdraft costs. Factors such as price increases due to inflation or exchange rate fluctuations for different currencies should therefore also be taken into account when using finway cards and an appropriate buffer should be set aside.

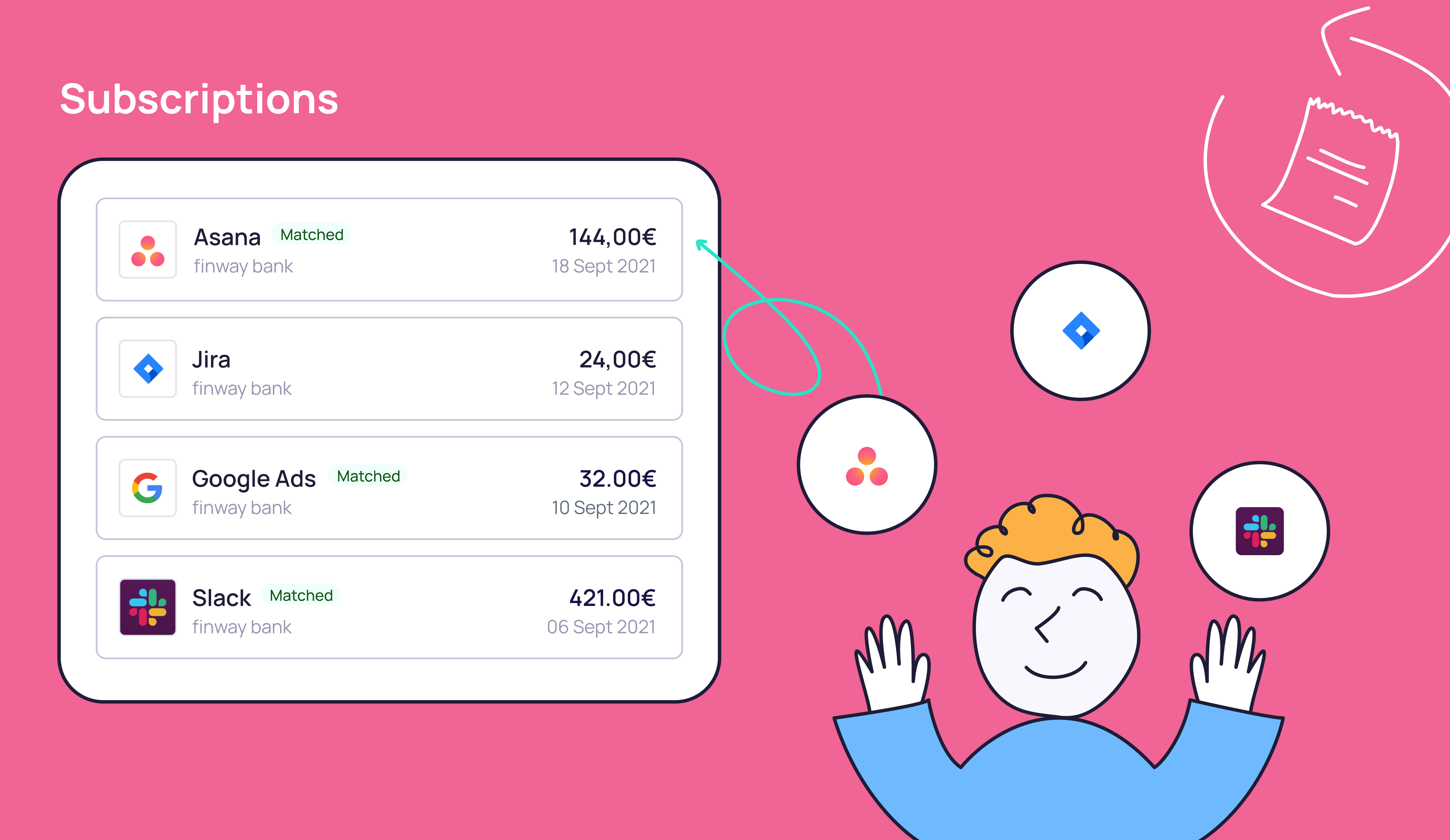

An example: A popular use of virtual cards in finway’s financial operating system is the payment of business subscriptions. This guarantees you maximum automation with high cost control. For example, if you pay 8.80 € per user and month for your Microsoft Office licenses, you should deposit this amount with margin on the card, for example 10 € instead. This way, you guarantee that payments that are highly relevant to your business will go through – but you still have full control over this transaction. In this case, the payment would only fail if unauthorized additional users were billed.

Our recommendation: Set the limit for your cards to the amount at which you do not yet want to be informed about a price change – so possibly higher transactions can go through without being double-checked by you.

I don’t want to give up the benefits of my current credit card!

Yes, miles or occasional rewards of collected points are a nice bonus; after all, gifts make each of us happy. Travel insurance is also a good additional service from many credit card providers – but usually only the person whose name is on the card benefits from it. So if Mrs. Johann books a trip by plane with the department-wide credit card, she is still not covered in the event of a claim.

Rewards programs are a proven method of customer loyalty. Over time, however, this type of business relationship should be reviewed to see if it is still relevant. How do you pay for these goodies? How much do your bank credit cards or the famous American Express cost per month, and how many corporate cards do you need in total? Do these costs pay off? And with increasing remote work and online meetings, do you still use your airline miles to the extent that you wouldn’t want to give them up in favor of a holistic solution with smart corporate cards and maximum planning security?

Ultimately, of course, it’s your decision whether you want to stick with external credit cards from the bank. We’ll just say this much: an all-in-one solution with card usage within a financial operating system like finway is, after initial conversion, something that gives you, your accounting department and your entire company security and budget control as well as flexibility for employees. Ultimately, this saves you time and money. This certainly is a benefit too, isn’t it?