Components of a travel expense management report

There are different types of travel costs and expenses, which also means that the required information differs in each case per trip – sometimes a private car and thus the mileage allowance is used, sometimes not – for example.

In any case, these data must be entered during the recording so that the business travel activity can be correctly recorded in the accounting and claimed for tax purposes under business expenses:

- Name of:the employee traveling

- Duration of the external activity incl. date and time

- Starting point and destination

- Purpose of the business trip

Travel expenses incurred by driving the employee’s own car are reimbursed with mileage allowances (for car or motorcycle trips) or with the actual amount. For concrete expenses with receipts (e.g. in the case of train travel), the reimbursement of travel expenses takes place via a reimbursement request. With regard to additional expenses for meals and accommodation, travelers are entitled to specific (half) daily rates – depending on the destination and duration of the trip. This entitlement is reduced accordingly if certain services (meals, overnight stays) were paid for or provided by the employer. Incidental travel expenses such as parking fees or entrance fees are often reimbursed in full by the employer.

If the employer sets expense guidelines, e.g. a certain ticket class for train travel or a certain upper limit for accommodation costs, employees should adhere to these in order to be reimbursed for all travel expenses later.

Advantages of a travel expense report software

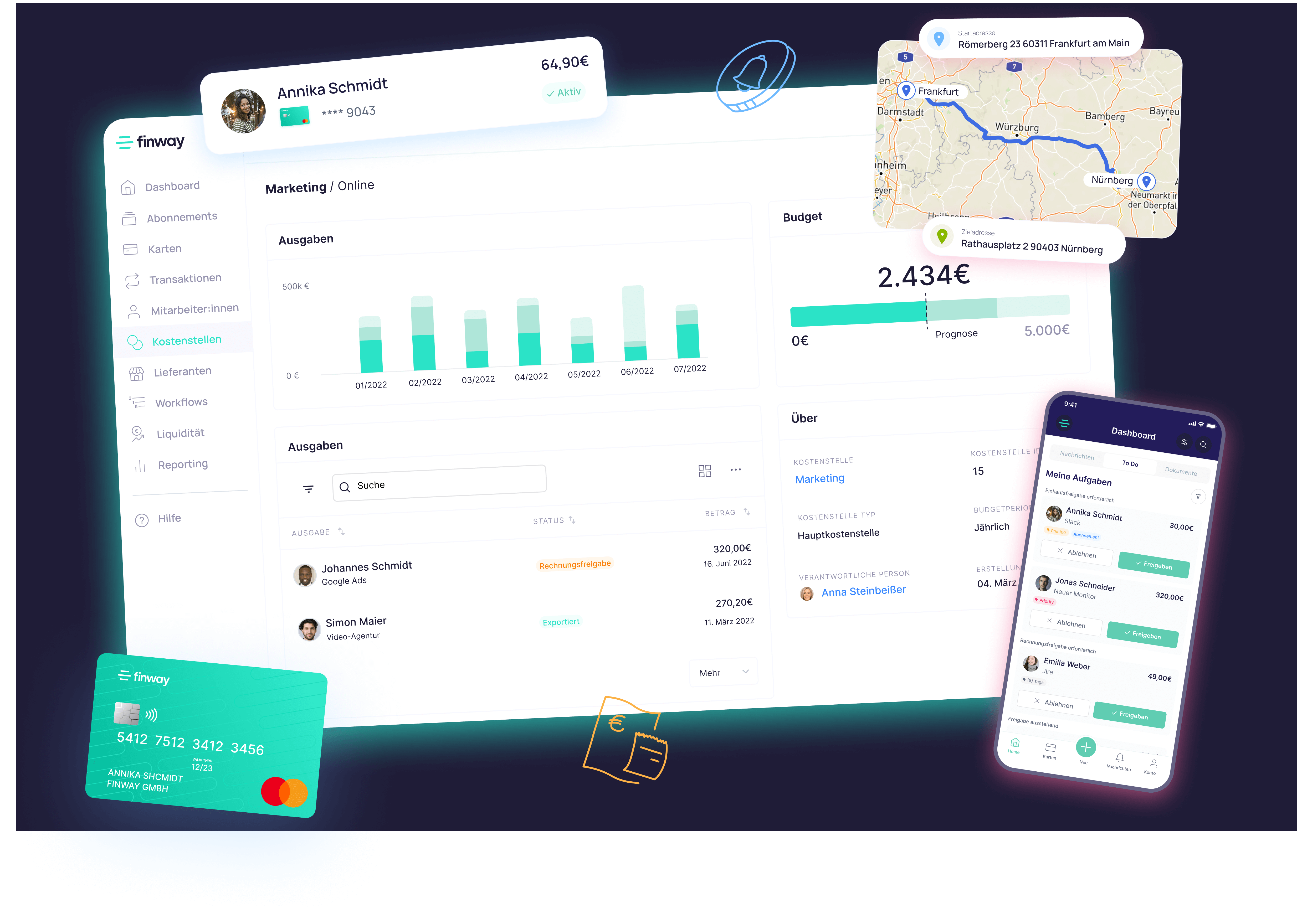

Analog travel expense reports are typically tedious, time-consuming and error-prone; the verification and reporting of all expenses is very time-consuming. Especially for larger trips, this can lead to long processing times and frustration for employees. With software like finway, travel expense reports can be easily digitized. The online travel expense report has various advantages for employees, approvers and the accounting department: