Business subscriptions are important for making everyday work easier – not only since the expansion of remote work. Whether it is communication within the team, project management, regular image editing or CRM and marketing, there is a suitable tool for every part of a company and every subtask. Since programs have been set up as cloud solutions, the hurdles to implementation have been knocked down. Subscriptions are completed with one click and tools are up and running. There’s no question that this is great, but it also is only economical up to a certain point. For SMBs, software subscriptions are now the second highest cost after salaries.

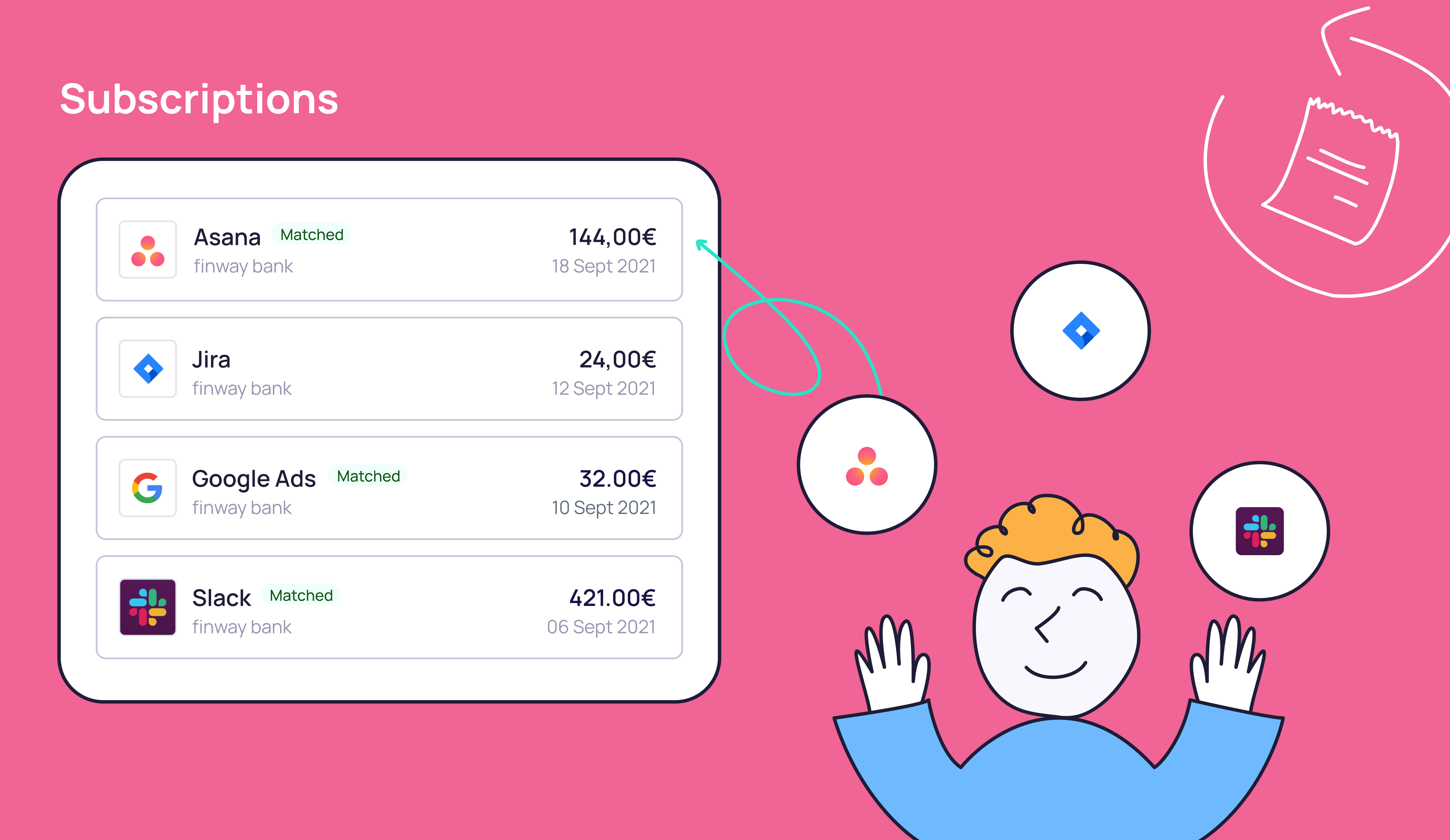

But do CFOs and finance managers have an overview of which providers the company subscribes to, how much money is spent monthly or annually on the respective tools, and whether everything is used at all?

Managing subscriptions is one of those things you quickly loose track of. You might know it from your private life, too. Once they’ve been taken out, they tend to be forgotten – until the next bill reminds you that you once bought an annual subscription for quite a bit of money. However, you don’t use it as regularly as you initially thought (or even need it anymore) – otherwise it wouldn’t have been forgotten. You can imagine how wild subscriptions can become in a business context, where it’s usually not just one or two paid subscriptions, but 50, 90, or even hundreds of applications in larger companies?