Accounts payable is an important part of any company. Whether a start-up, SME or large corporation, the proper management of incoming invoices is essential for the company’s continued existence. After all, paying receivables goes hand in hand with optimizing the company’s cash flow and working capital. Thus, accounts payable also takes on a strategic role.

Accounts payable: tasks & the strategic role for the company’s success

- Eva Harmeling

- 12.10.22

- 9 min read

What is Accounts Payable?

You cannot do without accounts payable (AP): it is the hub for all incoming invoices and their management. It serves to ensure that any liabilities that a company has to suppliers and service providers are actually paid. This guarantees that, on the one hand, supplier relationships are maintained and cared for and, on the other hand, financial advantages can be used through cash discounts or payments in advance.

The term “creditor” is derived from the fact that suppliers give companies a credit in the form of a service, which is then settled in the form of a compensation. In most cases, this is a previously agreed amount of money – so there is an offer and a suitable invoice, which must then be paid by the debtor (i.e. the company that has received the service). The classic incoming invoices of a company are therefore issued by the creditors of the respective business relationship.

What are the objectives of Accounts Payable?

Paying due invoices on time is important in every company – accordingly, this is the main goal of accounts payable. After all, nothing is more painful than having to pay unnecessary fines or even giving away a discount in the form of an early payment. Therefore, accounts payable should always maintain an overview of open items and process all incoming invoices correctly and promptly. This is the only way to ensure that all processes and purchased services by creditors in the company continue to run seamlessly, that the monthly settlement takes place on time and that relationships with satisfied suppliers are guaranteed.

Tasks of the Accounts Payable department

Let’s take a closer look. Accounts payable tasks include the following processes:

- Invoice verification

- Invoice capture

- Account assignment and accounting transaction of incoming invoices

- Management of open items

- Clarification of questions regarding invoices

- Approval, payment & archiving of incoming invoices

- Master data maintenance

Invoice verification

Invoice verification is an essential part of AP accounting. In this step, incoming invoices are checked for both formal and content accuracy. This is important, because only completely correct invoices entitle the company to deduct input tax.

An example of invoice verification that is close to everyday life is travel expense management. Here, the accounting department has to check the expenses of employees on business trips, because the settlements are bound to certain legal requirements. In the process, individual items must be checked and, if necessary, receipts must be requested subsequently as well as non-reimbursable expenses must be rejected. Finally, the correctly entered travel expense report, alongside all necessary receipts, is checked and payment instructions are given.

Invoice capture

After the invoice has been verified, the incoming invoices are captured by accounts payable. This involves assigning each invoice to the corresponding vendor via a vendor number. In this way, the invoices can be found again at any time and assigned to the corresponding payments. This step of invoice capture is mostly done digitally by now. Using programs such as accounting softwares or ERP systems, the invoices are digitally captured, read out and, if necessary, already pre-assigned.

Account assignment and accounting transaction of incoming invoices

Another to-do in accounts payable is the account assignment and accounting transaction of incoming invoices. The accounts payable clerk thus creates a posting record that addresses both the vendor account and the associated expense account. If your accounting department uses a software, it can already provide suggestions for the transaction account. The account then only needs to be finally checked, which ultimately saves time.

Management of open items

A central task of accounts payable is to always keep an eye on the cash flow and liquidity of the company. This includes positively influencing these very components through strategic invoice management. When managing open invoices, it is therefore not only important to avoid fines for late payments, but also to be able to use discounts effectively. Normally, suppliers offer a discount of 1 to 3 percent if the invoice is paid within a certain period. This is usually between 5 and 14 days.

Clarifying questions about the invoice

Certainly, questions can arise about an incoming invoice, whether regarding the amount or the justification of the order in general. Using an accounting software can minimize the workload here as well. With finway, for example, the accounting department can follow up directly with the colleague in question via a comment function. In this way, questions or problems with the invoice can be clarified promptly without wasting valuable time. At the same time, all agreements regarding an invoice are documented in the system in an unchangeable manner.

Approval, payment and archiving of incoming invoices

As soon as the incoming invoices have been checked and any queries clarified, they can be approved for payment. If the accounting department works with a software, this approval is usually just a click away. With finway, you can connect a bank account through which the incoming invoices can be paid directly. Afterwards, the invoice must be archived professionally and in accordance with GoBD guidelines (principles for properly maintaining, keeping and storing books, records and documents in electronic form and for data access, as provided by the German tax authorities), for example in case of a tax audit – the legislator specifies a retention period of 10 years in Germany.

Master data maintenance

As already mentioned, each vendor is given its own identification number so that suppliers can be clearly assigned at any time. This also includes master data such as the VAT identification number (VAT ID) of the vendors, as well as delivery and invoice addresses. All of this data must be regularly maintained by the accounting department to ensure that everything runs smoothly during invoice processing. If your accounts payable department uses a software such as finway, notes or recommendations can be stored in the supplier list in addition to essential information such as addresses and the usual cost center and G/L account.

Challenges of Accounts Payable

What are the biggest challenges that an accounts payable department must deal with?

- Missing receipts

- Late invoices

- Incorrect purchase invoices

- Duplicate purchase invoices

- Discrepancies between payment terms on invoices and purchase orders

- (Too) long approval procedures

All of these challenges can get in the way of a smooth accounts payable process. This in turn can lead to payment delays and thus wasted cash discounts, as well as blocking working capital due to invoices being paid too early (because there is an outdated deadline on the invoice compared to the negotiated purchase order).

According to a study by the Hackett Group, companies can improve their cash position by as much as $358 billion collectively – just by improving payment behavior. If that’s not a good reason to optimize accounts payable processes with a smart spend management solution like finway!

Advantages of digitization

At this point, let’s take another look at how digitization and automation will change your accounts payable. As soon as you manage your accounting in a software, you can not only save yourself a lot of manual work. Through intelligent solutions, you can streamline the entire process from purchase request to preparatory accounting.

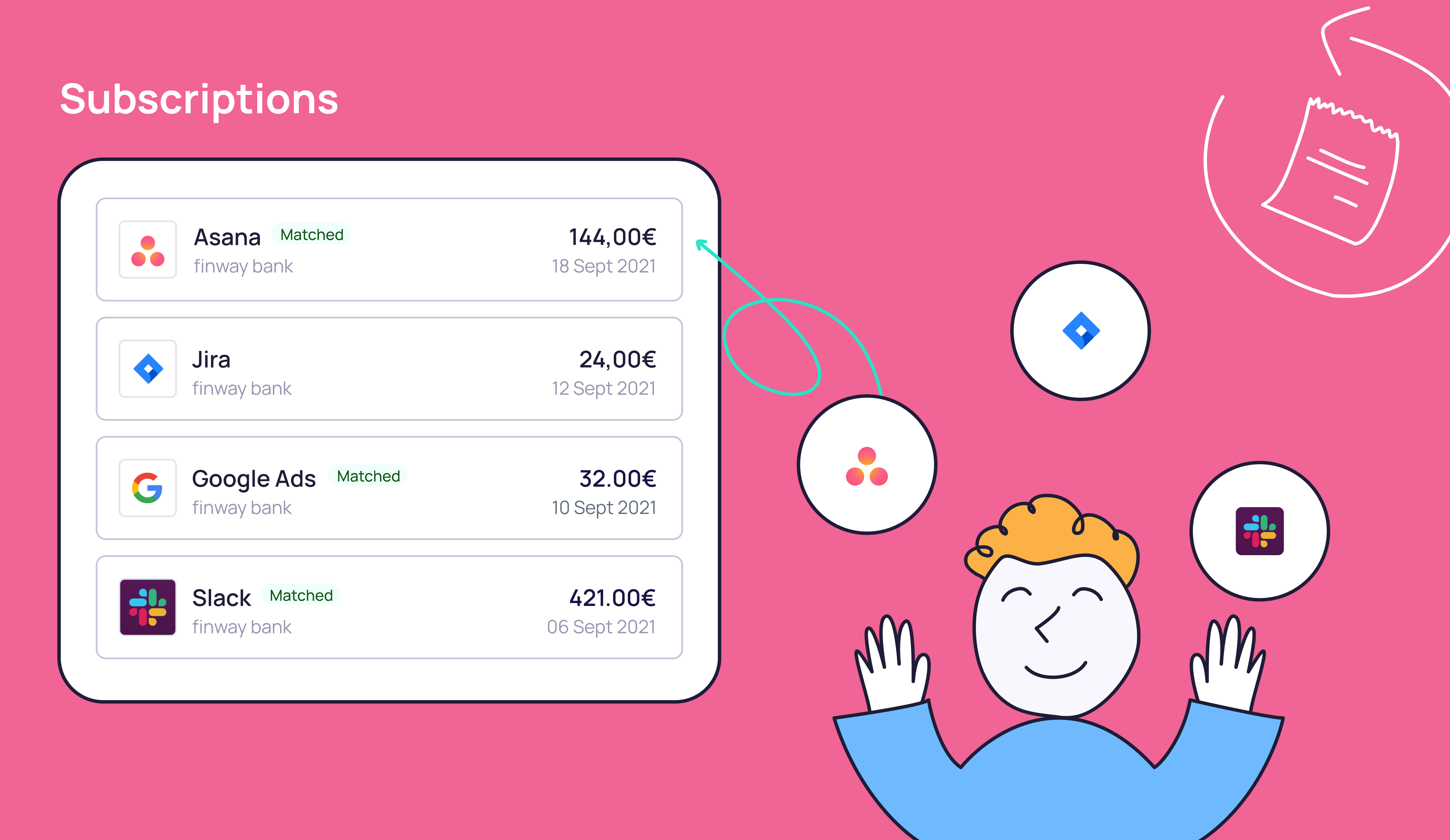

A tool like finway takes the often redundant, manual work off your hands, freeing up time for strategic tasks. Invoices and receipts for expenditures are automatically requested from the appropriate employee, and your accounts payable department can also pick up the factual invoice verification quickly and digitally from the colleague. Thanks to OCR, invoices are automatically read when uploaded to finway. So instead of time-consuming typing of individual invoice items, all you have to do is check the incoming invoice for accuracy.

Bonus: You can give your employees virtual as well as physical cards via finway, or have them make a purchase on account as usual. Since all payments are made from the finway software, you have a good overview of the development of budgets at all times.

What does an Accounts Payable clerk earn?

If you want to work as an accounts payable clerk, you can expect to earn between 30,000 and 50,000 € gross per year, depending on your experience. With increasing professional experience, it is possible to move to larger or international companies, where accounts payable clerks can expand their area of responsibility accordingly. In addition, there are special further training courses, e.g. with specialization in the subject of value added tax – this knowledge can strengthen the position in salary negotiations. Further training to become an IHK-certified accountant is also possible on a part-time basis.

What is expected of an Accounts Payable clerk?

As an accounts payable clerk, you need a preference for structure, independence and diligence. After all, tasks such as invoice verification and approval depend on the smallest detail. Flexibility, stress resistance (because yes, experience shows that a punctual monthly closing is often on the line) and the ability to work in a team are also qualities that are important and useful in this field. Due to the advance of digitalization, which also influences many areas of responsibility in accounting, accounts payable clerks should be open to new things and regularly want to advance their education.

What is the difference between Accounts Payable vs. Accounts Receivable?

Accounts receivable (AR) deals with outgoing invoices in comparison to Accounts payable (=incoming invoices). In addition to invoice entry, account assignment, verification and archiving of invoices issued, accounts receivable accounting is also responsible for the dunning process as well as for checking the credit status of the company’s customers. While accounts payable manage and pay incoming invoices, accounts receivable take care of invoices issued by the company itself for services.