Surprisingly, there is no “textbook-term” for purchase requests, but whether we use this one, purchase application or order request, you’d probably still know roughly what we are talking about.

Perhaps the reason for the lack of clarity is that purchase requests are not (yet) the most popular method for managing spendings in companies? The status quo has a great need for optimisation here!

A look at your status quo

How is purchasing done in your company at the moment? Purchases here simply mean everything where money flows out of the company, for example:

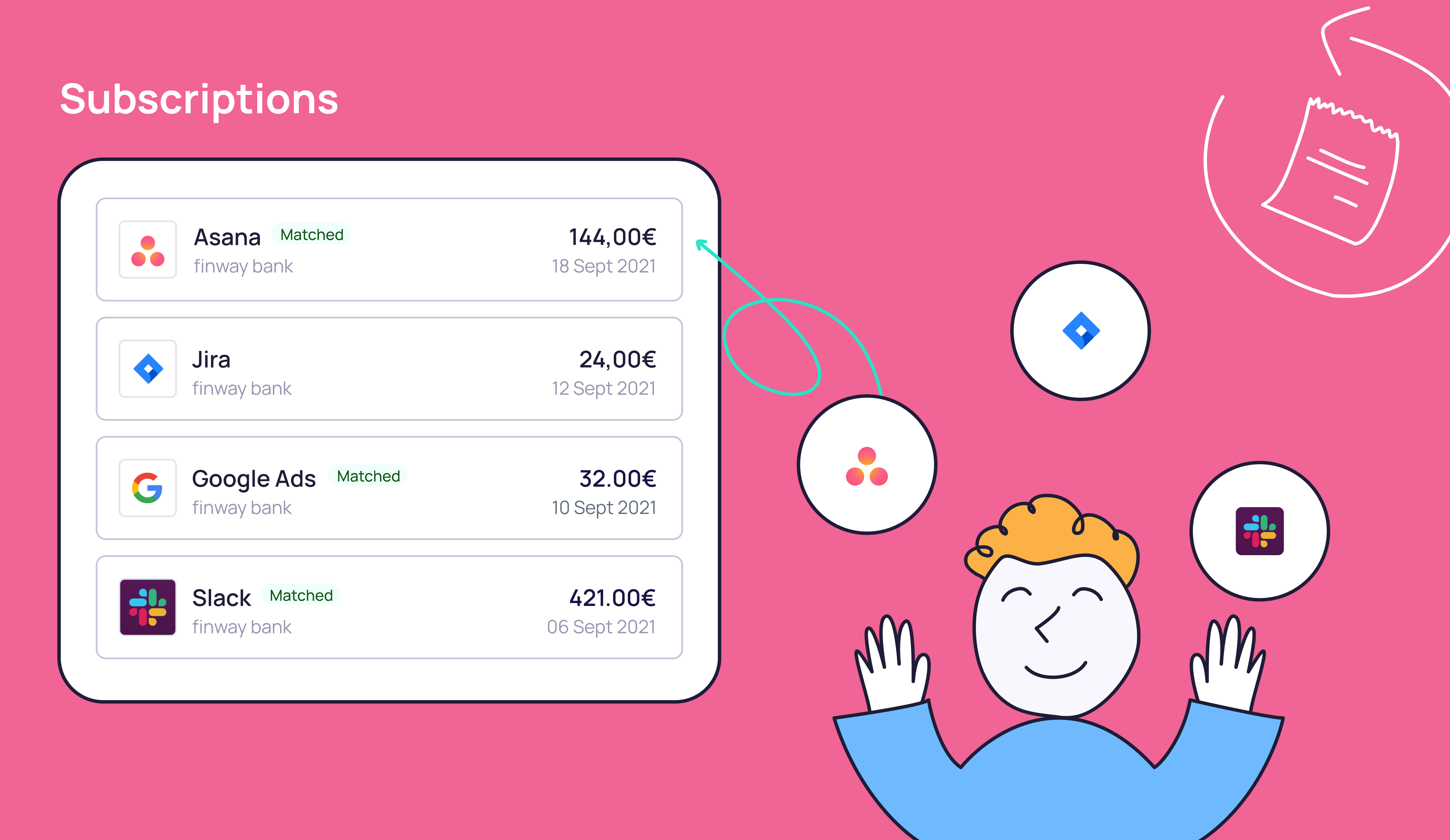

- Everything for the office and daily workflow (e.g. furniture, IT hardware and software, subscriptions, office supplies, catering).

- External staff (freelancers, consultancy contracts, etc.)

- Travel costs and expenses of staff

- Materials/logistics for production

- Expenses for marketing/advertising/PR (e.g. Google Ads)

- Notary, lawyer or tax consultant fees

- Insurances

- and much more.

Perhaps you are like many other small and medium-sized (or large) companies: you do not have clearly defined processes for these individual transactions. Approvals for purchases are made by personal agreement, if necessary by mail or telephone.