Advantages of digital expense management

Depending on the size of the company and the travelling activities of the employees, and without clear processes or the right tools, expense management in companies can become complex and time-consuming. A lack of approvals or expense guidelines makes it difficult to reimburse expenses later on and can lead to frustration among travelling employees as well as the finance department. You can automate your expense management with the right tool or simplify expense accounting. This results in the following benefits for the company, among others:

- Full transparency of all expense reports – at all times

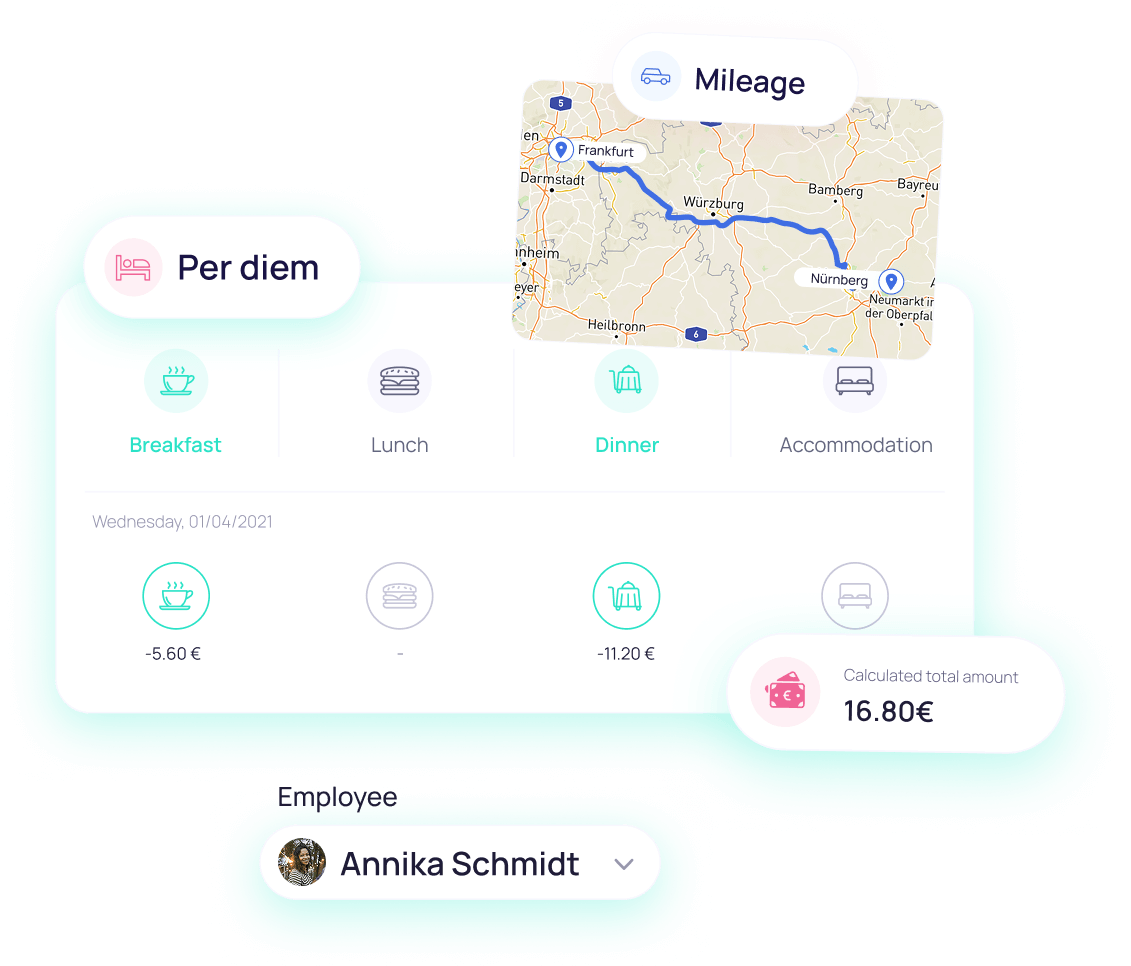

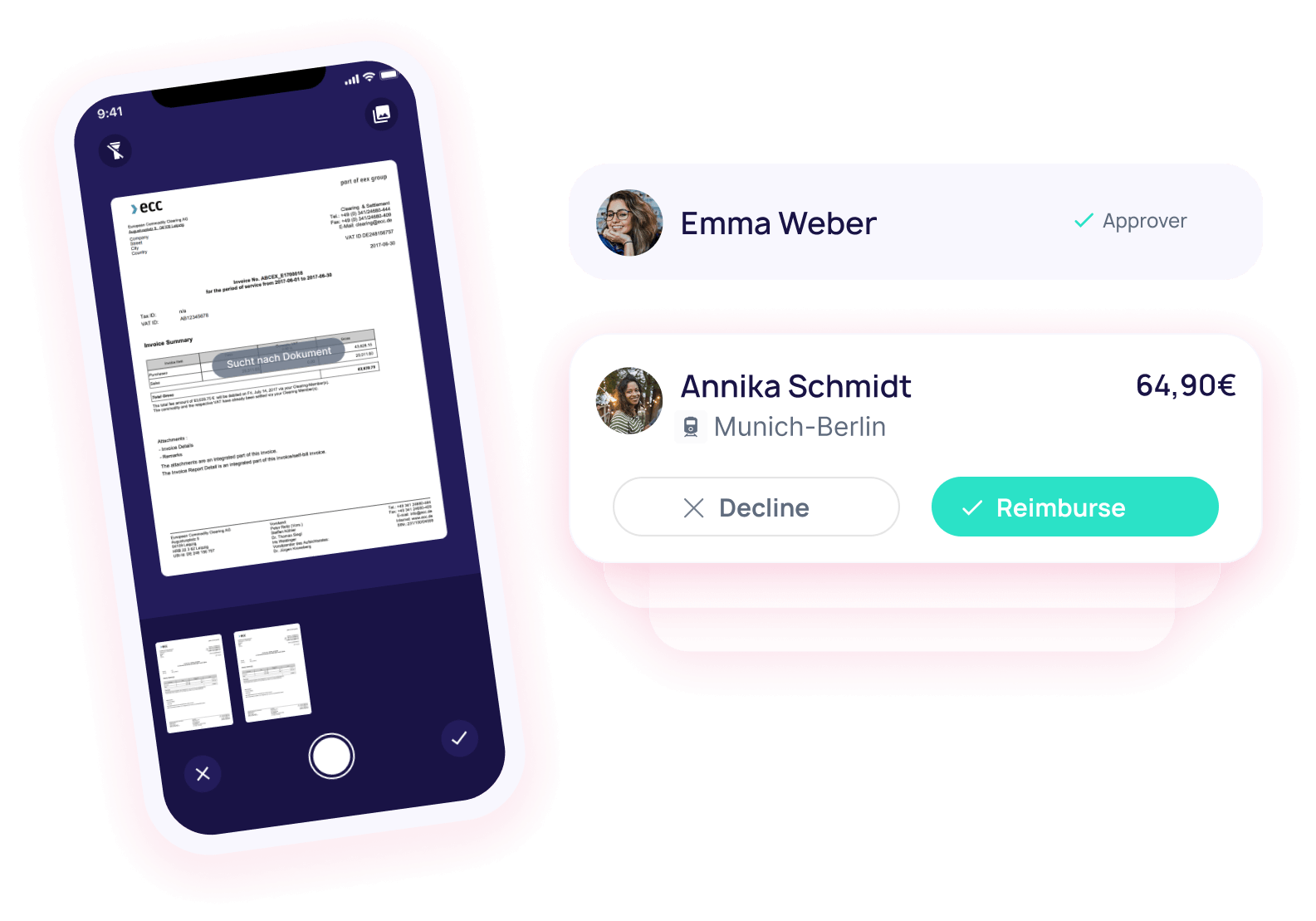

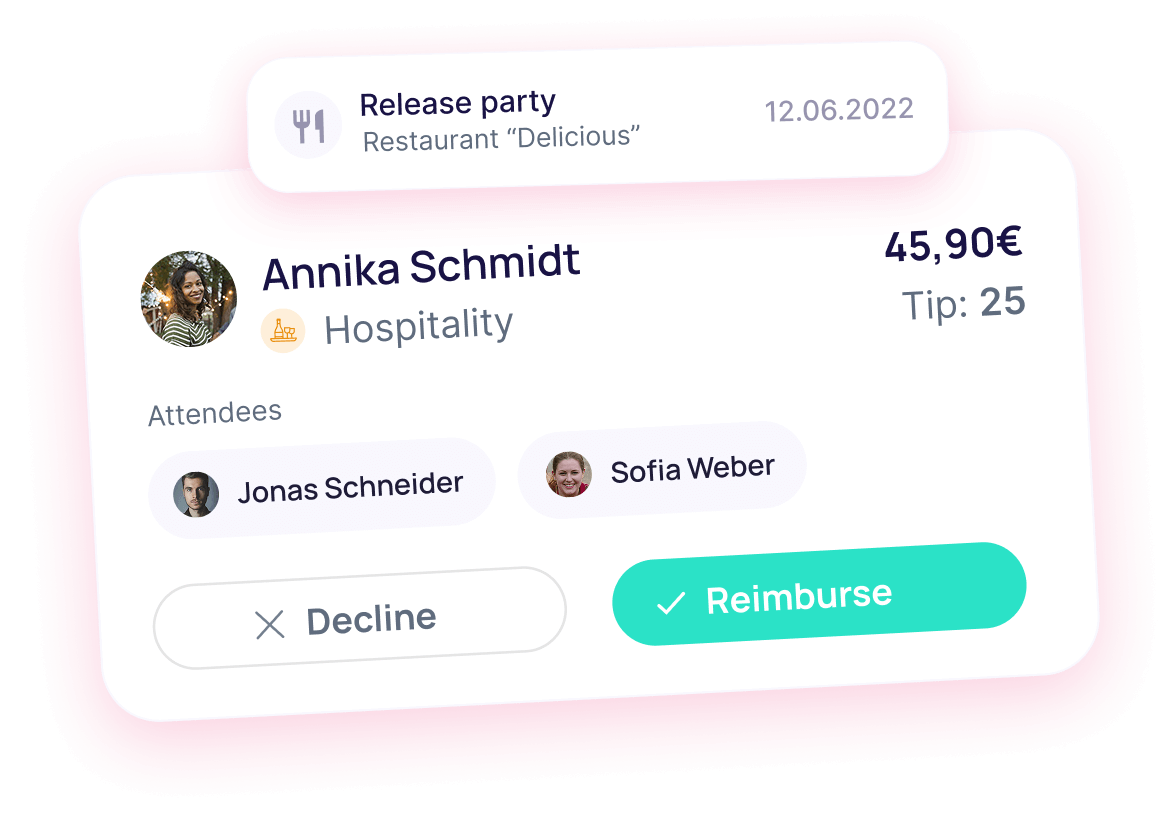

- Holistic expense management on one platform: from approval to reimbursement

- Reduction of manual errors thanks to tool support and automatic calculations

- Faster reimbursement of expenses

- Location-independent expense management thanks to SaaS solution and apps

- Integration of the entire company

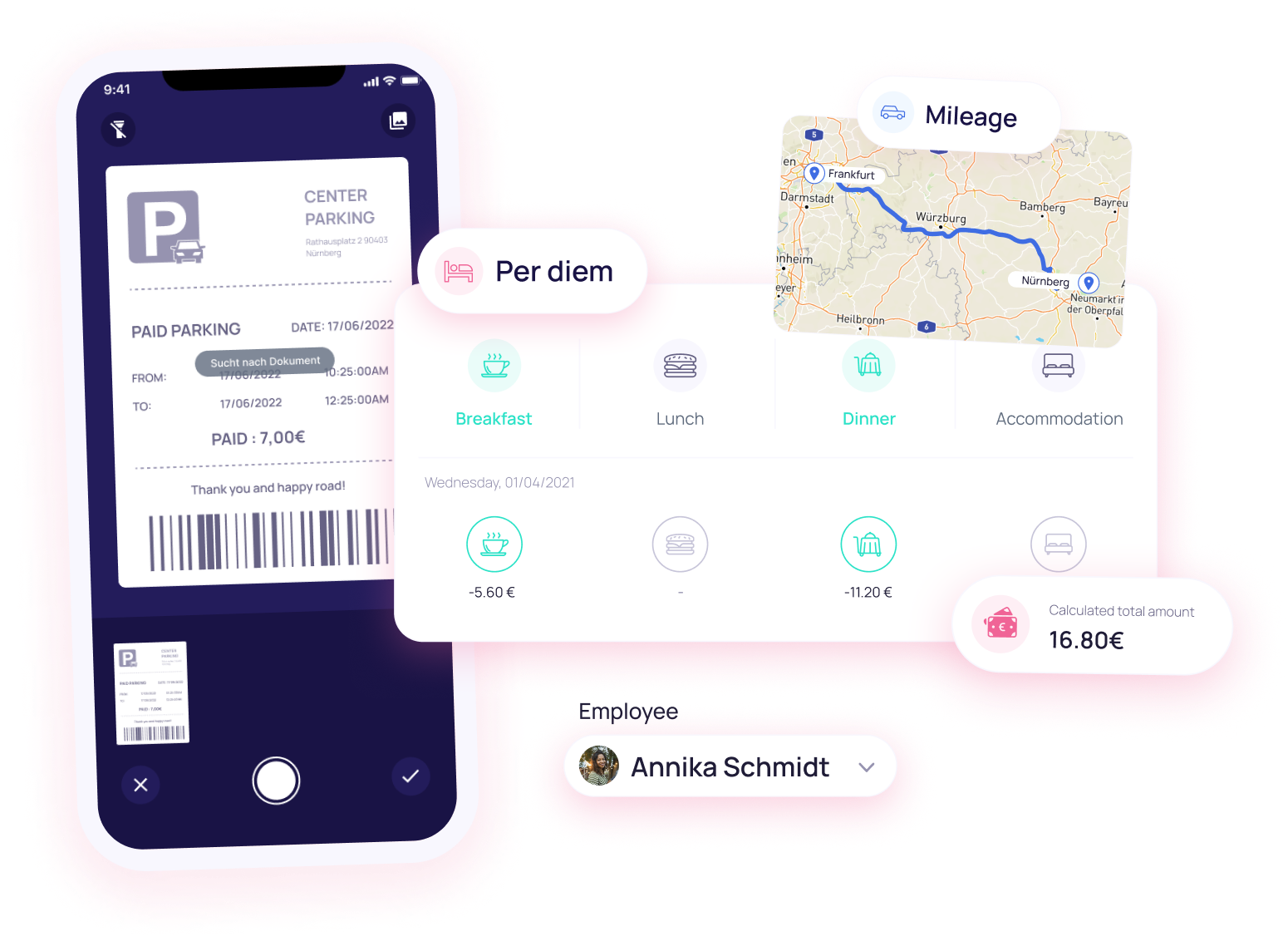

Simple creation of expense reports

Analogue expense reports can cause frustration and annoyance, especially for employees who travel a lot, if the reporting becomes too complicated, receipts have to be collected in folders and reimbursement takes too long. With finway, receipts can be uploaded quickly and easily, the necessary approvals can be obtained transparently and the entire expense report can be completed digitally and without a great deal of effort. This not only pleases finance teams, but the entire workforce.